Exploring the possibilities of a WhatsApp API for banking and fintech – WhatCX

Case Studies Conversational Leadership

Apurva Sharma

Published on 16 Feb 2023 10 min Read

10 min Read

Highlights

In recent years, messaging apps have become increasingly popular as a communication tool for businesses. WhatsApp, in particular, has seen significant growth in usage, with over 2 billion active users worldwide. With this many users, it’s no surprise that businesses are exploring the possibilities of integrating the WhatsApp API for banking and fintech purposes.

In this blog, we will explore the potential benefits and challenges of using the WhatsApp API for banking and fintech. We will also provide examples of how businesses can use this technology to improve customer experience and streamline their operations.

What is the WhatsApp API?

Before diving into the potential uses of the WhatsApp API for banking and fintech, it’s important to understand what the API is and how it works.

The WhatsApp API, or Application Programming Interface, is a tool that allows developers to integrate WhatsApp into their own applications. Using the API, developers can send and receive messages, notifications, and media through WhatsApp, which can be useful for businesses looking to reach their customers through the messaging app.

The WhatsApp API is designed to be used by large companies, focusing on providing a secure and reliable communication channel between companies and their customers. The API is available for companies in select countries and requires approval from WhatsApp before it can be used.

Benefits of using the WhatsApp API for Banking and Fintech

There are several potential benefits to using the WhatsApp API for banking and fintech. One of the most significant advantages is the ability to reach customers where they are. With over 2 billion active users, WhatsApp is one of the most widely used messaging apps in the world. By using the API, businesses can connect with their customers through a familiar and widely used platform, which can help improve customer engagement and satisfaction.

Another benefit of using the WhatsApp API for banking and fintech is the ability to provide personalized and efficient customer service. With WhatCX’s API, businesses can send automated messages, alerts, and notifications to customers, which can help streamline communication and reduce response times. Businesses can improve customer satisfaction and loyalty by providing quick and efficient service through WhatsApp.

The WhatsApp API can also help businesses reduce their operational costs. By automating certain customer service tasks through the API, businesses can free up staff time and resources for other tasks. Additionally, the API can be used to send payment reminders, account updates, and other important information to customers, which can help reduce the number of customer service calls and enquiries.

WhatsApp Chatbots for Banking and Fintech

WhatsApp chatbots are automated messaging systems that can be used by banks and fintech companies to provide customer support and other services to their customers. Fintech Chatbots can be programmed to respond to common customer queries, provide information on products and services, and even conduct simple transactions.

Here are some ways that banks and fintech companies can use WhatsApp chatbots:

- Account information: Chatbots can provide customers with information on their account balance, recent transactions, and other account-related information.

- Customer support: Chatbots can be used to answer common customer queries, such as how to open an account, how to transfer funds, and how to update personal information.

- Product and service information: Chatbots can provide customers with information on banking and financial products, such as loans, credit cards, and investment products.

- Transaction processing: Chatbots can be used to conduct simple transactions, such as transferring funds or paying bills.

- Investment advice: Chatbots can provide customers with investment advice, based on their investment goals and risk profile.

Chatbots can provide several benefits for banks and fintech companies. They can provide 24/7 customer support, reduce the workload of human agents, and provide a more personalized customer experience. Chatbots can also be used to collect customer feedback and data, which can be used to improve products and services.

Some examples of banks and fintech companies using WhatsApp chatbots include HDFC Bank in India, which uses a chatbot to provide customer support, and TransferWise, which uses a chatbot to provide international money transfer services. As the use of messaging apps like WhatsApp continues to grow, we can expect to see more banks and fintech companies using chatbots to improve their customer experience and grow their business.

Case Studies of Banks using WhatsApp API

Several banks around the world are already using WhatsApp API to provide customer support and other services. Here are some examples:

- Kotak Mahindra Bank: This Indian bank was one of the first to use the WhatsApp API for customer support. The bank uses WhatsApp to provide real-time support to its customers, including assistance with account opening, bill payments, and fund transfers.

- ICICI Bank: Another Indian bank, ICICI Bank uses the WhatsApp API to provide customer support and transaction alerts to its customers. The bank also uses WhatsApp to provide investment advice and updates on its services.

- Banco Bradesco: This Brazilian bank uses the WhatsApp API to provide customer support and to send transaction alerts and notifications to its customers. The bank also uses WhatsApp to provide personalized investment advice to its customers.

- Absa Bank: This South African bank uses the WhatsApp API to provide customer support and to send transaction alerts and notifications to its customers. The bank also uses WhatsApp to provide educational content and to conduct surveys to improve its services.

- Axis Bank: This Indian bank uses the WhatsApp API to provide customer support and to send transaction alerts and notifications to its customers. The bank also uses WhatsApp to provide information on its products and services and to conduct customer surveys.

These are just a few examples of banks that are already using the WhatsApp API for customer support and other services. As the use of messaging apps like WhatsApp becomes more widespread, we can expect to see more banks and fintech companies leveraging this technology to improve their customer experience and grow their business.

Challenges of using the WhatsApp API for Banking and Fintech

While there are many potential benefits to using the WhatsApp API for banking and fintech, there are also several challenges that businesses may face.

One of the biggest challenges is ensuring the security of customer data. Because the WhatsApp API is designed to be used by businesses, it requires approval from WhatsApp before it can be used. This approval process includes a thorough review of the business and its data security practices. However, even with this approval, businesses must still take precautions to ensure that customer data is kept secure.

Another challenge of using the WhatsApp API is the potential for misuse or abuse. Because WhatsApp is a widely used messaging app, businesses must ensure that their messages are not seen as spam or unwanted by customers. Additionally, businesses must ensure that they follow all relevant laws and regulations regarding messaging and customer communication.

Examples of using the WhatsApp API for Banking and Fintech

Despite the potential challenges, there are many ways that businesses can use the WhatsApp API for banking and fintech purposes. Here are a few examples:

- Customer service and support: One of the most common uses of the WhatsApp API is for customer service and support. By using the API, businesses can provide automated messages, alerts, and notifications to customers, which can help reduce response times and improve customer satisfaction. Additionally, businesses can use the API to provide real-time support through chat.

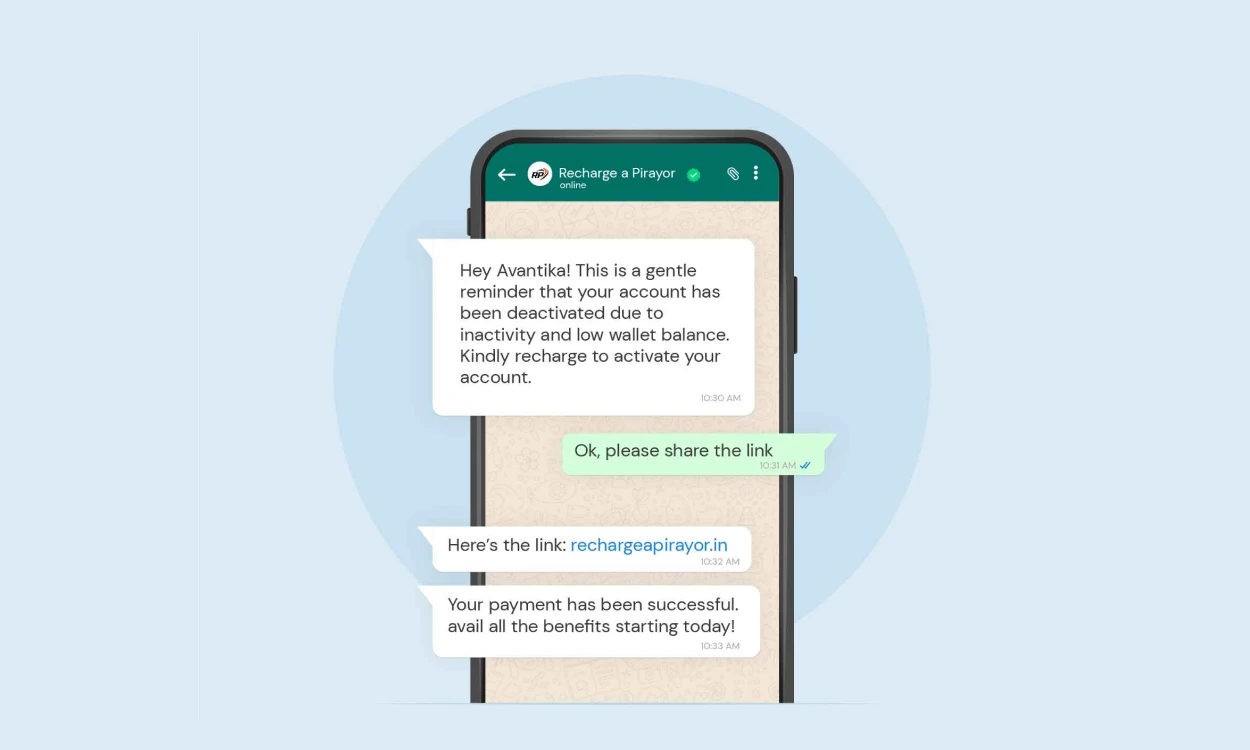

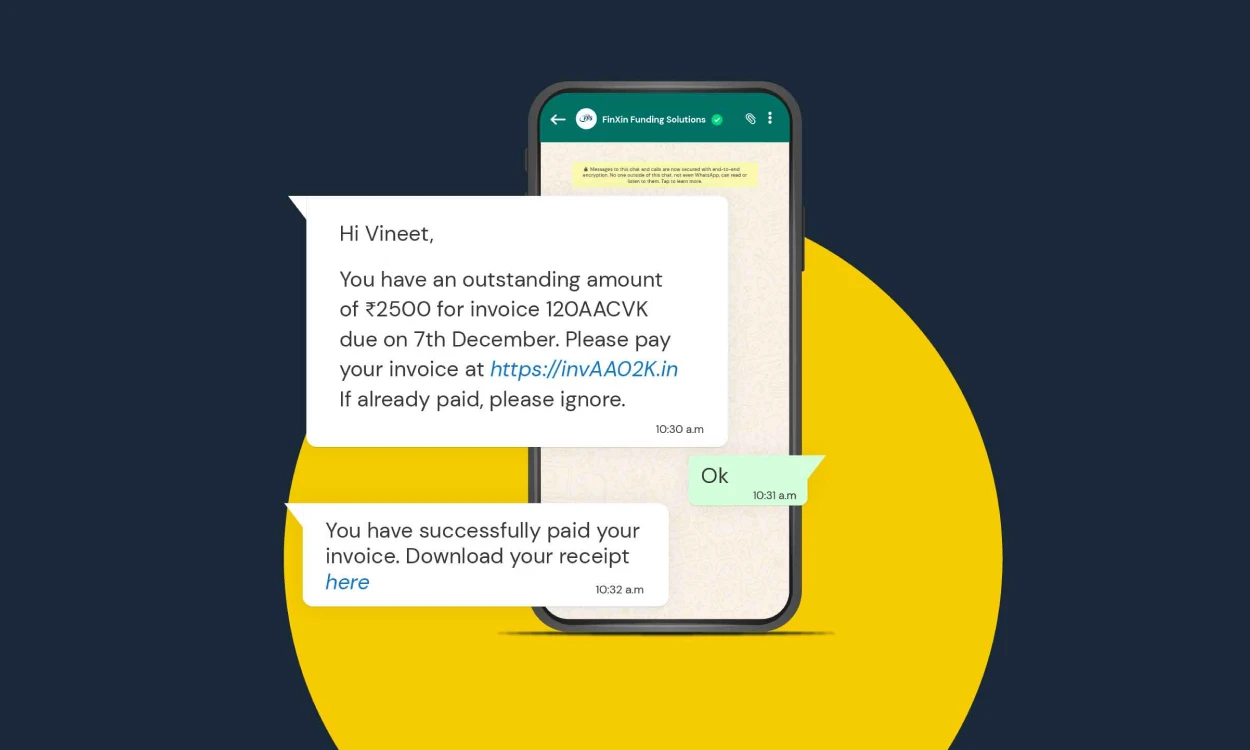

- Payment notifications and reminders: Another common use of the WhatsApp API for banking and fintech is for payment notifications and reminders. By using the API, businesses can send automated messages to customers regarding payment due dates, outstanding balances, and other important payment-related information. This can help reduce the number of missed payments and improve cash flow for businesses.

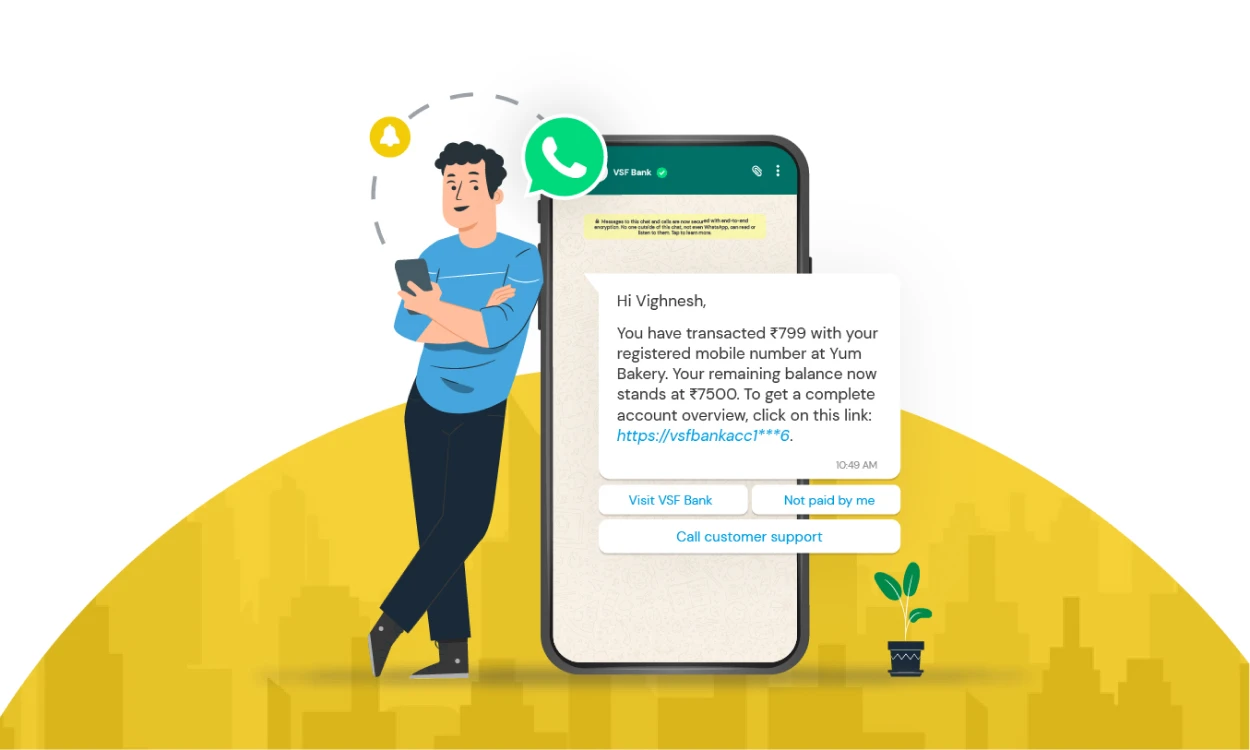

- Account updates and information: The WhatsApp API can also be used to send account updates and information to customers. For example, businesses can send automated messages to customers regarding changes to their account information, such as addresses or contact details. Additionally, businesses can use the API to send updates on account balances, transaction history, and other important financial information.

- Fraud prevention and security alerts: The WhatsApp API can also be used for fraud prevention and security alerts. For example, businesses can use the API to send notifications to customers regarding suspicious account activity or potential fraud. This can help prevent financial losses for customers and improve trust in the business.

- Marketing and promotions: Finally, the WhatsApp API can be used for marketing and promotions. By using the API, businesses can send targeted messages and promotions to customers, based on their interests and past behavior. This can help improve customer engagement and drive sales for businesses.

Why WhatsApp matters for Banking and Fintech?

WhatsApp is one of the most widely used messaging platforms in the world, with over 2 billion active users across more than 180 countries. This widespread adoption makes WhatsApp a valuable tool for businesses in many industries, including banking and fintech. There are several reasons why WhatsApp matters for banking and fintech:

There are several reasons why WhatsApp matters for banking and fintech:

- Customer engagement: WhatsApp provides a direct and immediate way for businesses to communicate with their customers. By using WhatsApp, businesses can engage with their customers in real-time, providing personalized and efficient support, and building stronger relationships. This can help improve customer satisfaction and loyalty, which is crucial in the highly competitive banking and fintech industries.

- Convenience: WhatsApp is a mobile-first platform, and many people use it as their primary communication tool on their mobile devices. By using WhatsApp, businesses can provide a convenient and accessible way for customers to access their financial information and services, without the need for additional logins or apps.

- Cost-effectiveness: WhatsApp can be a cost-effective way for businesses to provide customer support and services. By using the WhatsApp API, businesses can automate many of their customer interactions, reducing the need for costly human resources.

- Security: WhatsApp provides end-to-end encryption, which means that messages are secured and can only be accessed by the sender and recipient. This makes WhatsApp a secure communication tool for businesses in the banking and fintech industries, where privacy and security are of utmost importance.

- Innovation: By leveraging the features and capabilities of the WhatsApp API, businesses can create innovative and engaging customer experiences that set them apart from their competitors. For example, businesses can use WhatsApp to provide real-time updates on account balances, send payment reminders and notifications, and offer personalized promotions and offers.

Overall, WhatsApp matters for banking and fintech because it offers a convenient, cost-effective, and secure way for businesses to engage with their customers and provide innovative financial services. As more people around the world continue to adopt WhatsApp as their primary communication tool, businesses that embrace the WhatsApp API will be well-positioned to succeed in the evolving financial landscape.

To Sum Up

The WhatsApp API offers many potential benefits for businesses in the banking and fintech industries. By using the API, businesses can improve customer engagement, provide personalized and efficient customer service, and reduce operational costs. However, there are also challenges associated with using the API, including ensuring the security of customer data and avoiding misuse or abuse.

Despite these challenges, the WhatsApp API can be a valuable tool for businesses looking to improve their communication and engagement with customers. By using the API to send automated messages, alerts, and notifications, businesses can provide real-time support and information to customers, which can help improve customer satisfaction and loyalty. Additionally, the API can be used for payment notifications and reminders, account updates, fraud prevention, and marketing and promotions, which can help businesses improve their financial performance and grow their customer base.

Provide customers with easy access to account details and bill payments on WhatsApp. Use WhatCX’s WhatsApp API solution to address unmet customer needs, alert customers about transactions in real-time, allowing them to enquire about services seamlessly, send reminders for policy renewals or portfolio updates, and ensure the security of important documents is paramount.

Make your WhatsApp conversations faster, automatic, and more effective with your team.

Recent Blogs

30-03-2023

How to Create an Effective Lead Generation Campaign on WhatsApp

28-03-2023

What are the best WhatsApp Business API Providers? Find Out Now!

22-03-2023

How Stock broker companies use WhatsApp API to give insights into the portfolio to their ‘Customers’

19-03-2023

Impact of Automation in WhatsApp API Across Industries: A Closer Look

13-03-2023

How can the manufacturing sector leverage automation in WhatsApp Business API to help achieve their business goals

10-03-2023

What Are the Benefits of Using WhatsApp Business API Human Chat for Handling Sensitive Data?

10-03-2023

Is WhatsApp Automation the Future of the Automotive Industry?

06-03-2023

Utilizing the Power of WhatsApp Automation for HR Processes

06-03-2023